Objectives:

- Calculate your level of net worth or wealth using a balance sheet

- Analyze where your money comes from and where it goes using an income statement

- Use ratios to identify your financial strengths and weaknesses

- Set up a record-keeping system to track your income and expenditures

- Implement a financial plan or budget that will provide for a level of savings needed to achieve your goals

- Decide if a professional financial planner will play a role in your financial affairs

Reading For This Module:

Chapter 2 – Keown, Arthur, “Personal Finance: Turning Money into Wealth, Prentice Hall Publishing. 6thedition

Textbook PowerPoints (.pptx 873KB 23SL)

Opening Vignettes:

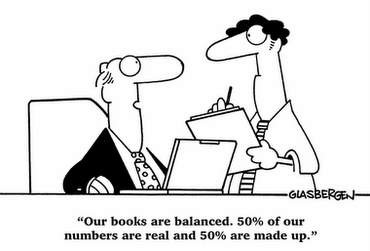

Your “books” are the best snapshot you have of your financial status. How much do you have? How much do you owe? You can make the best decisions in the world, but if those decisions are made on incorrect figures, you can end up at a negative balance and in a lot of trouble. How much do you HAVE to spend (fixed costs) before you even make any optional purchases (variable costs)?

© 2003 Randy Glasbergen

© 2003 Randy Glasbergen

Introduction: Financial Statements

This section establishes the importance of good record keeping and the use of financial statements. Balance sheets and income statements are the basis for most financial analysis, including the calculation of ratios to measure financial health.

The financial ratios discussed measure liquidity, debt, and savings. Strategies for developing and using a budget are explained within the broader context of financial planning. The benefits of budgeting, whether for individuals in financial trouble or for those seeking more control over their money, are considered.

Dr. Waller Lecture: Financial Statements (video) (09:54)

This video lecture covers the importance of Financial Statements in the financial planning process and corresponds to chapter 2 in textbook.

Financial Statements Lecture (.pptx 442KB 20SL)

Income & Expense Statements

The information and examples below are is provided as additional reference material.

Income and Expense Information (PDF)

Income and Expense Statements (PDF)

Income and Expenses (PPTX 5MB 44SL)

Reflection:Calculate your level of net worth or wealth using a balance sheet

- Use a balance sheet to determine the level of wealth that you or your family has accumulated on a given date

- Use an income statement to understand where your money comes from and goes to be able to save enough to meet goals

- Use financial ratios as targets or standards in managing financial resources

- A sound record-keeping systems makes tax preparation and tracking of spending easier

- Use a budget to plan and evaluate spending and saving