Objectives:

- Understand how credit cards work

- Understand the costs of credit

- Describe the different types of credit cards

- Know what determines your credit card worthiness and how to secure a credit card

- Manage your credit cards and open credit

Reading For This Module:

Chapter 6 – Keown, Arthur, “Personal Finance: Turning Money into Wealth, Prentice Hall Publishing. 6thedition

Opening Vignettes:

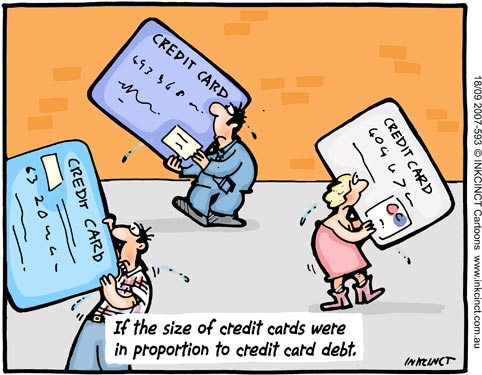

Too many people see credit cards as a blank check or a way to get things that they can’t afford. They’re not. Too often, carrying a balance with the minimum balance will have someone paying for that item many times over instead of saving for it and paying regular price!

Credit Card Debt Explained With a Glass of Water (video) (3:24)

Introduction to Credit Cards:

This section provides an overview of key concepts students need to know to select, use, and manage credit cards and open credit. Different types of credit cards and the various factors that affect the costs of using different types of cards are explained. Advantages and disadvantages of using credit cards are reviewed.

Creditworthiness, FICO credit scoring, and the functions of the credit bureau are considered. The section concludes with strategies for controlling and managing identity theft, fraudulent account use, credit overuse and bill paying problems. Federal consumer protection laws related to securing credit, using credit, and credit reporting are also reviewed.

Dr. Waller Lecture: Credit Cards (video) (40:33)

This video covers Credit Cards in which we buy now and play later, but if not paid off, you’ll incur fees in the form of interest rates. Watch for why you need a credit card in this modern era and how to keep yourself form being financially crippled by excessive credit card debt and strategies for getting out of this hole if you are in it.

Credit Cards Lecture Powerpoint (.pptx 42sl, 1.1MB)

Additional Optional Resources for this module. (material will be on graded assignments)

Webinar: How to Read Your Credit Report | Virginia Credit Union

3 steps to rebuild your credit

Meet Winston: Credit Score

Meet Winston. He’s a sensitive guy who feels he’s figured out the world of dating women until he needs to check off his most important date requirement….a good credit score. Watch his financial story unfold as he learns the details of achieving good credit.

Your Credit Score Explained

A great credit score makes your life easier in so many ways. In this short video, you’ll see how to build, maintain, and manage the kind of credit score you want.

Which accounts help you save? Which accounts can make you even more money?

Credit Cards: Additional Facts & Information

Please print out, read and complete the worksheets below.

These handouts are provided for additional reference on credit cards.

Credit Cards Overview – How They Work (.pptx 18sl, 891KB)

Having a credit card is not a blank check. It is a great convenience, but when not paid off monthly, that convenience has a severe cost. Look at this sample bill to see how to read a statement and learn related vocabulary.

Credit Card Information (.pdf 6pp 365KB)

Identity Theft

Webinar: Avoiding Identity Theft

Everything’s online these days. And while that gives you more opportunities to do all the things you want, it also leaves more opportunities for others to get your valuable information. We’ll show you how to protect yourself from identity theft and let you know what recourse you have if the worst happens.

One common consequence of identity theft is credit card fraud.

Identity Theft (.pdf 5pp, 209 KB )

What is Identity Theft? How does it happen? What can you do to prevent or recover from it?

Reflection

- Main form of open credit is the credit card which you can use to make charges up to a certain point as long as you pay off the minimum amount of your debt each month

- Costs of open credit include interest rate, cost of cash advances, annual fee, penalty fees

- Choices of open credit lines include different types of credit cards and charge accounts

- Lenders determine creditworthiness using the “five C’s” of credit—character, capacity, collateral, and condition

- Different credit cards charge different APR and calculate finance charges differently

- Focus on controlling credit card spending and look for signs of trouble

Practice Quiz (does not count toward grade)

SEE ALSO:

Credit Card Trivia (.pptx 39sl, 400KB)

Practice your Credit Card knowledge in this “Jeopardy!” style game. Play the game in “presentation mode”.